Agent Welcome Kit

Welcome to the Colorado FAIR Plan

We’ve built our organization, products, and systems from the ground up, so we could design a FAIR Plan that is financially stable, resilient in the event of a crisis, and right for Colorado.

FAIR Plan policies are for high-risk residential and commercial properties whose owners have received three declinations from standard market insurers and have been unable to find coverage elsewhere. Our policies usually provide limited coverage at a higher price.

Understanding the Colorado FAIR Plan

FAIR Plan policies are a bit different than standard market policies. To understand these differences, we have created a side-by-side comparison of the coverages available with a standard homeowners insurance policy versus the limited coverages offered by the FAIR Plan.

Remember, the Colorado FAIR Plan provides Actual Cash Value coverage (ACV), not replacement cost coverage. Our residential maximum is $750,000, while our commercial maximum is $5,000,000.

A lot of people have wanted to know about Actual Cash Value (ACV) and how it is determined. The coverage reflected on the application is the property’s ACV, which is automatically calculated by e2Value based on the property’s replacement cost. You can access the e2Value report within our system and share it with your clients.

Residential Coverage

We are pleased to offer you both a residential product and an automated system that provides agents with the ability to provide quick quote options, submit applications, and communicate directly with underwriters within our Agent Portal.

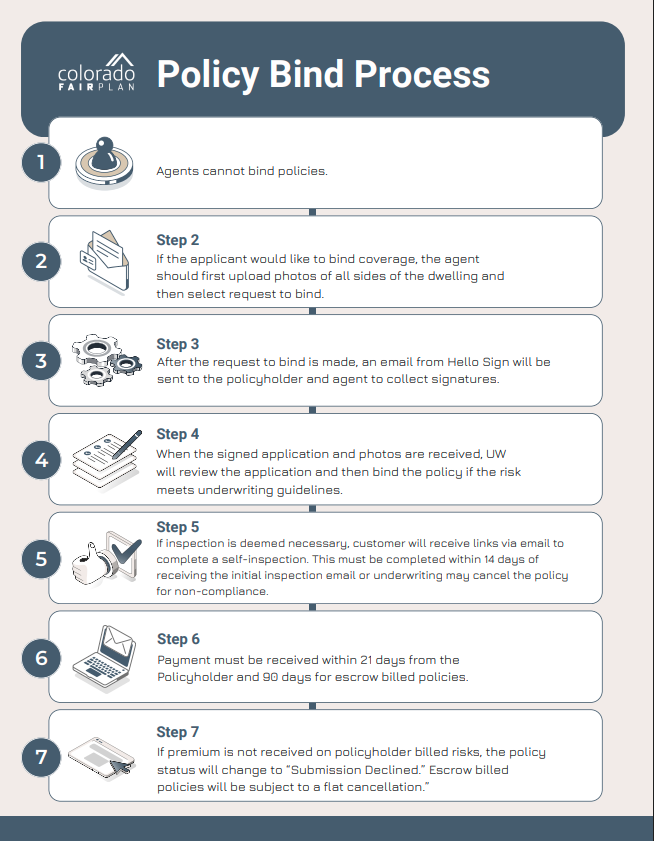

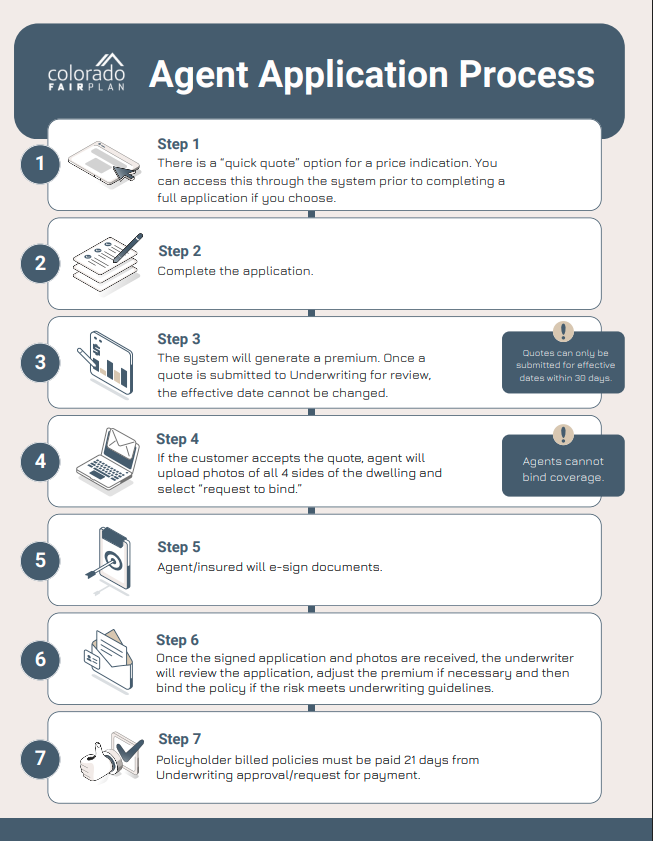

Application and Binding Processes

We’ve created graphic overviews of the application process and the policy binding process, so that you know the steps that you and your clients need to take to purchase coverage.

Commercial Coverage

Agents who possess a valid P&L license and are registered to write Colorado FAIR Plan policies can access our commercial product. Before accessing the Colorado FAIR Plan commercial product, it is important that you know the following:

An agent must be registered to write the Colorado FAIR Plan and hold a valid Colorado Property and Casualty (P&C) license to access the commercial product. Agents who only hold a personal lines license will not be eligible to access the commercial product.

An applicant must have three declinations from the admitted market to be eligible for FAIR Plan coverage. Those declinations must be within 45 days of the application.

Commercial limits are $5 million per LOCATION. A “location” may have multiple buildings less than 100 feet apart. A policy may have multiple locations if the buildings are more than 100 feet apart. We have more details on this specific point in our Commercial Lines FAQ.

The Colorado FAIR Plan policy can act as a primary layer; therefore, the Colorado FAIR Plan can accept risks with an ACV above $5 million.

Currently, the commercial product is available via a manual underwriting process. This process involves completing a fillable PDF risk submission form and submitting it to the underwriting department. Underwriting will rate and provide quotes via email. Similar to other commercial lines, much of the application process will take place outside of the Agent Portal.

We have outlined each step required to properly prepare and submit risk forms and applications in our Manual Submission Process. Please take a moment to become familiar with the process and its steps here.

Phase 2: Commercial System Launch

We are eager to launch Phase 2, which will be an automated and fully integrated commercial system. In this system, you, as agents, will be able to quote our commercial products directly, just as you can with residential products. However, until that system is launched, our commercial product will be a more traditional manual product.

The Colorado FAIR Plan website can help you and your clients understand our commercial product with resources that include:

Commercial Lines FAQ

CSP Mixed Occupancy Rules and Class Codes

Construction Definitions and Rules

ACV Condition and Building Description Glossary

Manual Submission Workflow

Risk Submission Form

Sample Commercial Policy

Online Resources

Consumer Resources Page: This is a valuable resource for clients seeking additional information about the Colorado FAIR Plan. From finding an agent, reading a sample policy, or paying a premium, our goal is to ensure that consumers have what they need to make informed decisions and take action regarding their FAIR Plan policies.

Agent Portal: Now that you’re registered, you can log in to the Agent Portal directly.

Premium Payments: Clients will receive an email with a link to pay their premium, and an online payment feature is also available on our website for easy access.

Claims Process: At this time, all claims are reported by phone using our toll-free number (833) 554-5425 with the support of a member of our Customer Care Team. The Consumer Claims page directs policyholders to first contact their agent to determine if the damage that occurred is covered by their FAIR Plan policy. We then list the information policyholders need to have on hand when they call.

Fire Preparedness: Boulder County and its Wildfire Partners program shared these DIY fire mitigation strategy videos with us. We have posted them on our Consumer Residential Resources page. Feel free to share them with your colleagues and customers.

Policy Binding Moratorium: When active fires are present, policy binding moratoriums may be implemented. They will apply to pre-evacuation (yellow) and evacuation (red) zones according to the Ready, Set, Go stoplight protocol used by state and local officials across Colorado.

Moratorium notifications will be posted on our website. As always, if you have questions, please call our Customer Care Team.

Need Help?

Even though you’re new to the Colorado FAIR Plan, you’re not alone. We have an incredible Customer Care Team ready to assist you. They can be reached at (833) 554-5425 from Monday through Friday, 8:30 am to 5:00 pm MST. Don’t hesitate to contact them.